Just because home sales are slowing and mortgage rates are climbing, you shouldn't expect any home price corrections, according to the latest forecast by the B.C. Real Estate Association (BCREA).

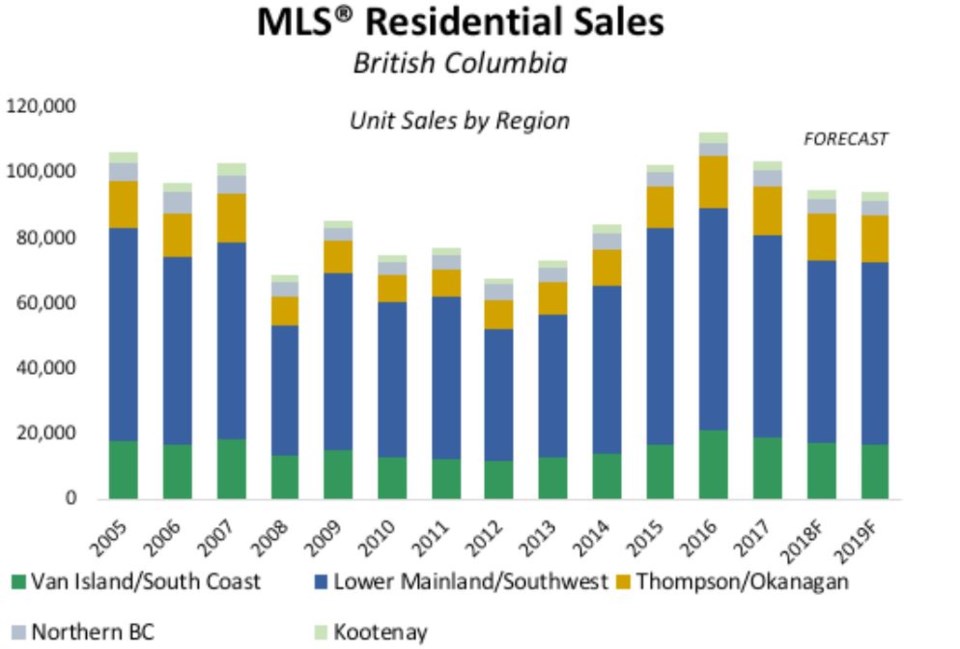

The association reported March 9 that residential resales on the MLS® are forecast to be 8.6 per cent lower this year than in 2017, reaching a full-year total of 94,855 units. That would be the first time in three years that sales total less than 100,000, but is still higher than the 10-year average sales total of 84,800 homes.

BCREA also predicted that sales would drop further – but only very slightly – in 2019 to 94,025 units.

“Housing demand in the province is expected to moderate this year and in 2019,” said Cameron Muir, chief economist at BCREA. “More stringent mortgage qualifications and rising interest rates will further erode affordability and household purchasing power.”

The BCREA forecasts that the five-year qualifying rate is forecast to rise 35 basis points to 5.49 per cent by Q4 2018, and another 21 basis points to 5.7 per cent by Q4 2019. If this happens, under the new mortgage qualification rules, mortgage applicants will have to qualify at 5.7 per cent or 2 per cent more than their contracted interest rate, whichever is the greater. With the average five-year contracted mortgage rate predicted to rise to 3.84 per cent in the same period, most buyers could be looking at qualifying at nearly 6 per cent by the end of 2019.

Despite the slowing sales and rising rates, the BCREA is forecasting that MLS® home sale prices across B.C. will continue to increase – by 6 per cent to $752,000 (average over the whole year), and a further 4 per cent to $781,800 in 2019.

The Fraser Valley and Vancouver Island are expected to see the biggest price rises this year, at around 8 per cent, while some Northern B.C. regions are predicted to see slower price rises of less than 2 per cent. However, no regions are forecast to see any price declines either this year or next year.

The BCREA points out the predicted price rises are much lower than price increases seen in the past few years, due to the rising interest rates, tough mortgage rules and an anticipated boost in housing supply from current new construction.

Read the full BCREA forecast report with regional breakdown here.