The B.C. government tabled another balanced budget Tuesday (February 19), along with billions earmarked for childcare, healthcare, education and transportation.

Over the next three years, Budget 2019 commits $20.1 billion to infrastructure, $1.3 billion for childcare and more than $900 million on the CleanBC program announced late last year. Government also announced a revenue-sharing agreement that will deliver approximately $3 billion in total to all First Nations communities over the next 25 years — the largest such agreement in B.C. history.

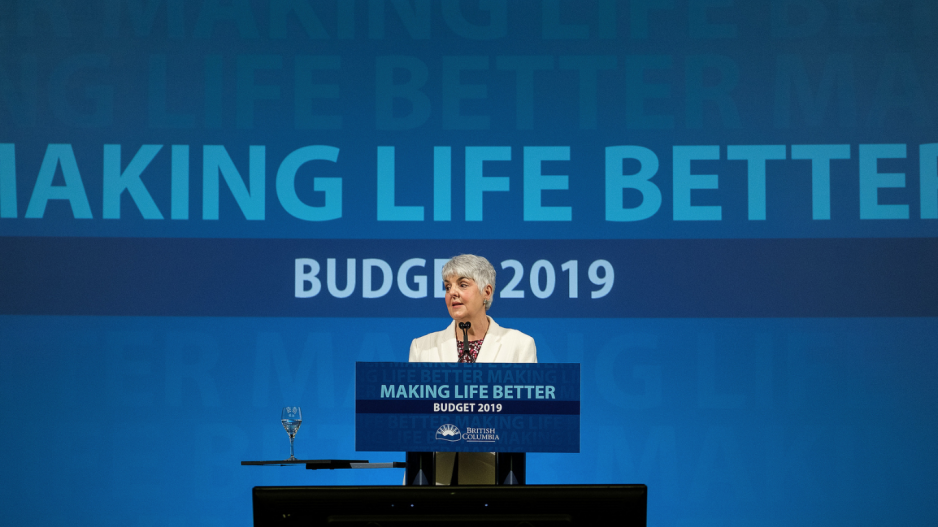

“To build a strong economy, we need a strong foundation,” said Minister of Finance Carole James in her budget speech.

This is the second budget from the current B.C. NDP that manages record-breaking spending commitments while maintaining a budget surplus.

This fiscal year, the province is forecasting a surplus of $274 million, followed by surpluses of $287 million and $585 million in 2020 and 2021, respectively. It also eliminated its operating debt last year.

Revenue is expected to climb gradually over the next three fiscal years, from around $59 billion, to $60 billion, to $62.5 billion. Rising with it is the province’s debt-to-GDP (gross domestic product) ratio, expected to reach 15 per cent in 2019 (up from 14.9 oer cebt in 2018) and climb to 16.1 per cent by 2021.

While government is anticipating stronger-than-expected economic growth over the next three fiscal years (LINK), it has built-in forecast allowances of half a billion dollars this fiscal year, followed by $300 million in both 2020 and 2021. It has also factored in contingencies of more than $1.5 billion over the next three years.

The spending in Budget 2019 follows a $7-billion commitment over 10 years to housing affordability measures and a $1.5-billion commitment to the province’s health-care system made in Budget 2018.

Last year, government also committed to eliminating medical services plan (MSP) premiums, which will be completely phased out by 2020. This year’s budget shows that elimination will result in an annual $2.7-billion revenue reduction. When combined with the employer health tax (EHT) — which took effect this year — the net revenue loss is expected to total $800 million.

Other notable revenue adjustments last year include a $325-million reduction in property transfer tax (PTT) revenue, a $496-million larger-than-budgeted loss at the Insurance Corporation of British Columbia (ICBC), a $1.1-billion loss at BC Hydro, and a $65-million (-28 per cent) drop in natural gas royalties. Taxation revenue tied to B.C.’s forests were $397-million higher last year than previously budgeted.

Following the tax competitiveness measures introduced in Canada’s fall fiscal update, businesses in B.C. will be able to immediately write-off specified machinery and equipment purchases and to accelerate the cost allowance on capital investments. Over the next three years, the temporary measures are expected to cost the province around $800 million in foregone corporate tax revenue.

The province says the effect of those changes, which are designed to enhance the country’s competitiveness, along with the investment into B.C. made by LNG Canada, are expected to result in an average 4.3 per cent growth in annual tax revenue.

— Haley Woodwin, Business in Vancouver