The 2025 budget that will see the owner of the average Prince George home pay $13.35 more in property taxes to the Fraser-Fort George Regional District.

The district’s board of directors held its second and final budget meeting for 2025 on Wednesday, Feb. 19. While final approval of the budget still must take place at the board’s March 20 meeting, further amendments are unlikely.

The first budget meeting held on Jan. 24, 2025 focused on the budgets for services across the entire regional district as well as sub-regional services that affect multiple of its constituent municipalities and electoral areas.

The budget items approved at the January meeting require the regional district to requisition $1,261,748 more in taxes from its residents compared to 2024.

Residents only pay taxes towards regional district services that benefit the area they live in, meaning the tax change depends on where someone lives.

By comparison, the Feb. 19 meeting primarily discussed services that affect individual electoral areas. The items discussed at this meeting required a $349,786 additional requisition increase compared to 2024.

That includes a $218,914 budget increase for fire and rescue services, $52,000 more for community grants in aid, $45,292 more for library funding, $35,444 for recreation and community halls and $473 more for street lighting.

There’s also a $2,337 decrease in TV rebroadcasting expenses for Valemount, McBride and Electoral Area H.

Changes to operating expenses in the proposed budget include:

- $145,624 in inflationary expense increases that were somewhat offset by cost reductions for waste reduction due to the district’s agreement with Recycle BC

- $1,031,067 in increased remunerations to district staff representing cost of living adjustments and new staffing

- $2,340,093 in one-time expenses relating to the Dore River Mitigation Projects

- $479,978 increase to debt servicing expenses

- $409,869 decrease in transfers made to the district’s reserves

Capital projects discussed at the February meeting include $1,592,221 in fire and rescue service projects, $593,201 for projects at recreation and community halls and $170,000 for water and sewer projects.

Those fire projects include:

- $983,146 for Beaverly Fire Protection, including a payment of $533,146 for a new frontline engine, $300,000 for the replacement of a 1990-era cab and chassis and $150,000 for replacement self-contained breathing apparatuses with newer used units

- $200,000 for Buckhorn Fire Protection as a payment towards a new frontline water tender

- $200,000 for Salmon Valley Fire Protection for the construction of a new outbuilding

- $94,075 for McBride District Fire Protection to develop a water supply site

- $55,000 for Ness Lake Fire Protection to install new wall insulation at the fire hall

- $30,000 for Pineview Fire Protection to run power to training grounds

- $30,000 for Area D Rescue Service to also run power to training grounds

The community and recreation centre projects include:

- $370,000 for the Robson Valley Recreation Centre to repair and retrofit the exterior of the building for $330,000 and $40,000 to replace the projector and sound system

- $166,646 for Nukko Lake Community Hall, with $148,503 going to water and sewer system upgrades and $18,143 for roof repairs

- $56,555 for Dome Creek Recreation Facility for energy efficiency upgrades to windows, siding and insulation

The water and sewer projects include:

- $65,000 to replace and electrical panel and program a computer for the Azu Water System

- $30,000 to rehabilitate the electrical power bank and system at the Bear Lake Water System

- $25,000 to replace an aerator for the Tabor Lake Community Sewer System

- $25,000 to install an aerator for the Bendixon Community Sewer System

- $25,000 to install an aerator for the West Lake Community Sewer System

The total requisition in 2024 was $22,613,500. The budget as passed for 2025 increased the tax requisition to $24,225,034. That’s an increase of 7.13 per cent.

In total, the district’s 2025 budget features $70,049,346 in total expenses.

After a presentation from district staff, the local area budgets were passed by the board with only a single modification.

Vice-chair Art Kaehn (Woodpecker-Hixon) proposed that the community grants in aid allocation be reduced for his electoral area from $115,000 to $95,000.

His motion passed, reducing the amount of total operating expenses and grants in aid from the proposed budget by $20,000. It also resulted in the tax increase for the average home in Electoral Area E going down from 7 per cent to 1.7 per cent and the overall tax requisition increase for the entire district going down from from 7.13 per cent to 7.04 per cent.

That actually means the tax rate per $100,000 of assessed value went down from $128.86 in 2024 to $118.92 in 2025, but the cost per average home went up from $222 to $225.68 because of assessment increases.

Director Dannielle Alan (Robson Valley-Canoe) advocated for the board to lobby the provincial government to properly fund volunteer fire departments as some of them are faced with either disbanding or downsizing to brigades due to a lack of funding.

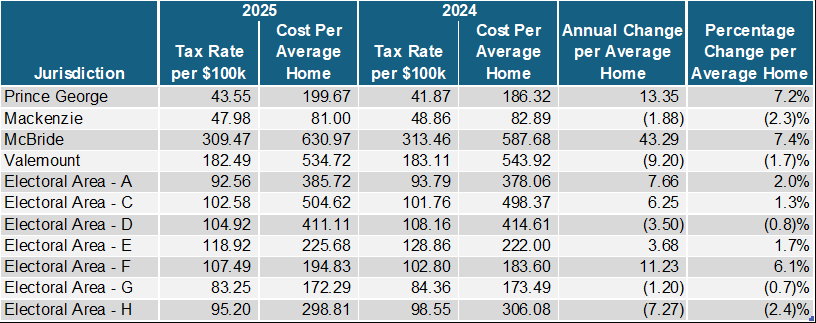

BC Assessment’s 2025 values listed the average assessed value of a single-family home in Prince George as $451,000. The requisition approved by the board for the district’s 2025 budget means that home will pay about 7.2 per cent or $13.35 more in district taxes for a total of $199.67.

Here’s the percentage and dollar amount change for the average assessed home in the rest of the regional district now that February’s deliberations have concluded.

- Mackenzie: 2.3 per cent decrease ($1.88)

- McBride: 7.4 per cent increase ($43.29)

- Valemount: 1.7 per cent decrease ($9.20)

- Electoral Area A (Salmon River-Lakes): two per cent increase ($7.66)

- Electoral Area C (Chilako River-Nechako): 1.3 per cent increase ($6.25)

- Electoral Area D (Tabor Lake-Stone Creek): 0.8 per cent decrease ($3.50)

- Electoral Area E (Woodpecker-Hixon): 1.7 per cent increase ($3.68)

- Electoral Area F (Willow River-Upper Fraser Valley): 6.1 per cent increase ($11.23)

- Electoral Area G (Crooked River-Parsnip): 0.7 per cent decrease ($1.20)

- Electoral Area H (Robson Valley-Canoe): 2.4 per cent decrease ($7.27)

Budget talks for the Fraser-Fort George Regional Hospital District are scheduled to take place next month. That budget will have a separate impact on district residents’ overall property tax bills.