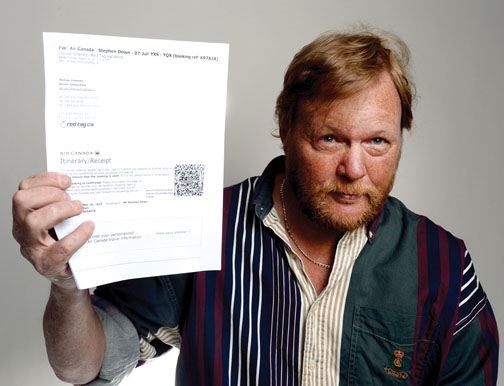

What Stephen Down thought was an unexpected windfall soon became a nightmare.

For the past three years, the 55-year-old former sawmill worker has been living on a disability pension of just $906 a month and, given his low income, was expecting an income tax return of $88.74.

But in March, he suddenly discovered $9,620.15 had been deposited in his bank account, courtesy of Canada Revenue Agency.

Suspecting something was awry, Down wanted to get confirmation that the money really was his before daring to go on a spending spree. But when he went to his bank to double check, the teller assured him there were no problems.

"It's from the government," Down said he was told. "Go have fun!"

It put Down in a buoyant mood.

"I came out of that bank with bells and whistles on. Ching, ching!" Down said.

Indeed, it was enough to prompt him to head to a local travel agent and buy a ticket to fly to Newfoundland in early July to see his parents - his father is in ill health - at a cost of $1,247.15.

Then he went to a local supermarket and spent an additional $200 or so on groceries and admitted to spending a further $200 on beer.

"I wanted to celebrate," Down said.

But almost as soon as he spent the money, he learned it wasn't his after all. The entire $9,620.15 was taken back out of his account leaving Down with an overdraft of $1,600.23. Once he's paid his rent and his cellphone bill, Down lives on just $366.45 for the rest of the month, so he was stuck with a debt he doubted he could ever pay off.

It also created a big load of stress that he, of all people, did not need.

A series of family tragedies - in the span of about a year, he lost his wife then his daughter to cancer - left Down suffering from post-traumatic stress disorder. He walked away from his house in Mackenzie and, after a stint at Baldy Hughes, moved to Prince George where he is now receiving therapy.

"It kind of messed me up," Down said. "I never really got over the loss."

Fortunately for Down, he found an advocate in Emily Moliere, the administrator at his psychiatrist's office, who agreed to go to bat for him.

But they soon discovered they were in for a long, hard battle as everyone, from the CRA to the airline to the travel agent to his bank were taking a hard line.

Despite explaining Down's story to Air Canada and Red Tag, they refused to refund his ticket while CRA said it was ultimately Down's responsibility because he knew how much he was expecting back for a tax refund.

As for his bank, Moliere said RBC initially demanded he pay the overdraft back at a rate of $160 per month, plus interest. But after Moliere intervened, the manager was able to get permission from his superiors to lower it to $25 per month.

Although less onerous, Down said it's still a big expense for him. Moreover, RBC withdrew his $88.74 income tax refund he was actually entitled to plus his quarterly GST credit of $120 and put them towards the overdraft. (The bank cannot touch his disability cheque, Moliere said).

Then he and Moliere turned to The Citizen for help.

Within a day of being contacted by the newspaper, Air Canada said it would refund the ticket and, a few days later, Red Tag called Down to say the cheque was in the mail. On Monday it arrived and on Tuesday, Down took the cheque to RBC where it was deposited against his overdraft.

By then, RBC had also agreed to reverse all the interest that had been charged on the overdraft, which had added up to $43.28 so that by Tuesday, the debt Down owed to RBC was down to $220.09.

Down is happy with that. Simply getting the refund on the plane ticket was good enough for him. Moliere, however, believes RBC could have forgiven the rest of the debt given that one of its tellers assured Down the money was his.

"I'm glad that RBC forgave the interest but in all honesty, I would think they could have stepped up to the plate with a little bit more than they did," said Moliere, who had similar comments for CRA.

But what caused all the trouble in the first place? A clerical error, it appears.

In their search for answers, Moliere and Down obtained a copy of the form he had filled out to get federal government payments deposited directly into his bank account. Oddly, under the section for income tax refunds and GST credits, someone other than Down had written in a social insurance number that was not his.

In another section regarding direct deposits for old age security and Canada Pension Plan and in handwriting that is clearly Down's, the correct social insurance number is written in. Down suspects the error occurred when he took the form to the provincial social services office but beyond that is at a loss to explain how it happened.