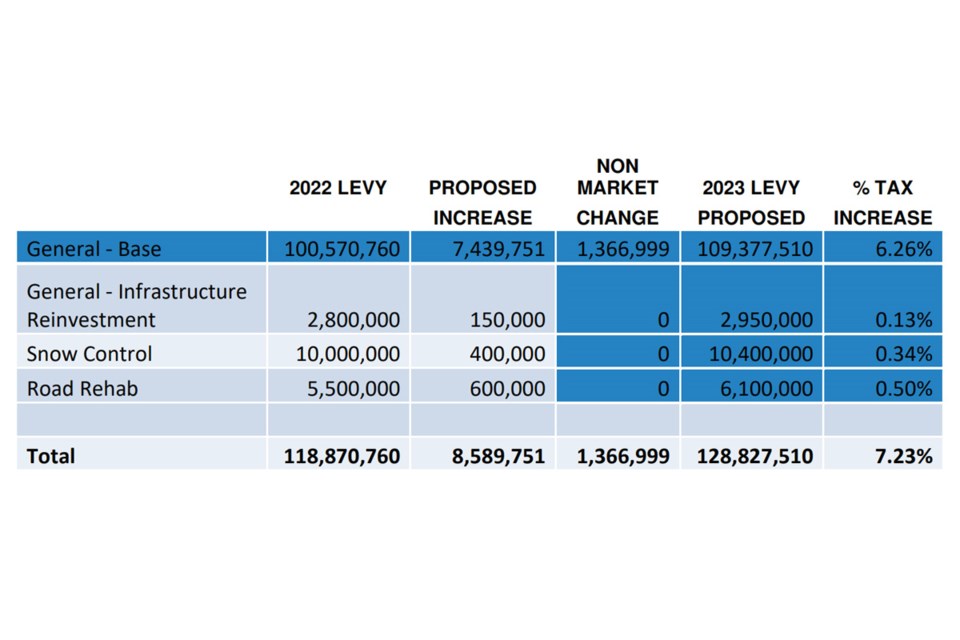

City council will be facing a proposed 7.23 per cent tax increase on Monday, as they begin deliberations on the 2023 city budget.

The city’s proposed 2023 operating budget, to maintain services at existing levels, is $128.83 million – up nearly $8.59 million from 2022, according to a report going before city council on Monday. Taxes on new developments are expected to offset roughly $1.37 million of that increase, leaving $7.22 million to be made up in additional property taxes.

If city council approves two proposed service enhancements, the annual tax increase could rise to 8.17 per cent.

Each percentage point of tax increase equals a roughly $23 per year increase in property taxes for a typical single-detached house in Prince George, according to the report. A 7.23 per cent increase would result in an average $166.29 Increase for a typical home, while a 8.17 per cent increase would result in an average $187.91 increase.

The assessed value of a representative single-family home in Prince George for 2023 was not provided in the report. In 2022, it was $410,891.

In 2022, Prince George had the second-highest municipal property taxes per capita among B.C.'s 20 largest municipalities at $1,464 per person. However, the total property taxes and fees for an average-priced, single-family home were the third lowest among B.C.'s biggest municipalities, at $4,942.

The proposed addition of four additional uniformed RCMP officers, and two municipal police support staff, would increase the city’s budget by $1.02 million in 2023. In December, city council received a consultants’ report saying city needs 19 additional uniformed police officers, 10 additional civilian support staff, an unknown number of additional data entry personnel and a “peer navigator” based in the Prince George Public Library, over the next five years.

Also proposed is a $100,000, one-time cost to conduct a feasibility study on developing a fire training centre in Prince George for the Prince George Fire Rescue Service.

WAGES, DEBT DRIVING COST INCREASE

A two per cent wage increase for unionized and non-union staff, salary increases for the RCMP negotiated by the federal government, and the addition of the equivalent of 14.41 new full-time positions are significant cost drivers for the 2023 budget.

The additional positions include the equivalent of 9.5 full-time positions to operate the Canfor Leisure Pool, one heavy-duty mechanic for the city’s fleet operations, one cybersecurity position for the city’s IT department, one project estimator for the city’s capital projects department and two additional staff in the Fire Operations Communications Centre (those two are paid for by the Regional District of Fraser-Fort George).

The city is also facing a $2.32 million increase in its debt-servicing costs in 2023, after taking on $33.94 million in debt in 2022. Of that debt, $25.5 million was for the Canfor Leisure Pool, with the remaining new debt acquired for upgrades to Masich Place Stadium, Ron Brent Park, expansion of the city mausoleum and several road and culvert upgrade projects.

B.C. SAFE RESTART GRANT COULD REDUCE TAX HIKE

The City of Prince George has $2.86 million remaining of the $6.11 million it received from the provincial government’s COVID-19 Safe Restart Grant in 2020. City council authorized using money from the fund to offset property tax increase in 2021 and 2022.

If city council approved using the last of the Safe Restart funding this year, it would reduce the proposed property tax increase by 2.4 per cent to 4.83 per cent for 2023. However, the money is a one-time funding source and wouldn’t be available in 2024 to offset the increase again.

PUBLIC INPUT WELCOME

Members of the public are invited to provide their input to city council on the budget in writing, by phone (1-877-708-3350, access code 1269574#) or in person during the budget meetings on Jan. 30 and Feb. 1. Public input sessions will take place at 3:30 p.m. and 6 p.m. on both days, in council chambers at city hall (second floor).

Budget documents can be found on the city’s website, or hardcopies are available at the city hall service centre.

Written comments must be submitted by noon on Monday, by emailing [email protected], faxing 250.561.0183 or in person at city hall.

For more information, go online to the citys’ website.