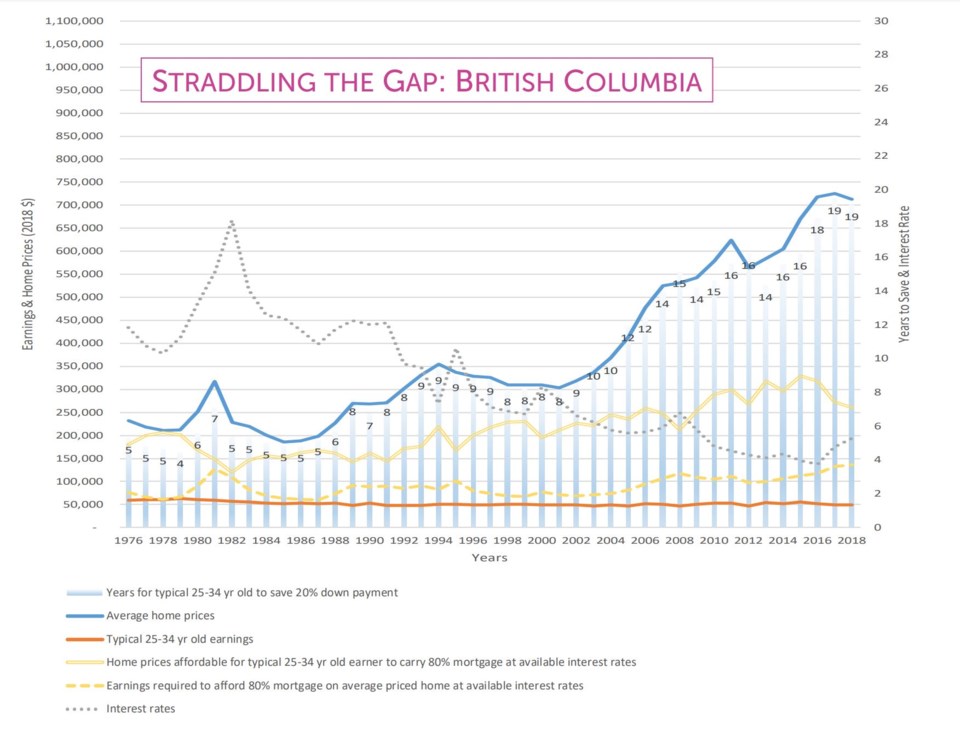

The average home in B.C. is priced at nearly three times what a typical Millennial can afford, according to a study released June 13 by housing advocacy group Generation Squeeze.

The $700K-plus price tag for an average home in the province would have to be reduced by $452,000 – close to two-thirds of the current value – to under $250,000 to be achievable for a 25-34-year-old on a typical annual salary, according to Straddling the Gap.

That’s based on the buyer spending 30 per cent of their income on mortgage payments, having a 20 per cent down payment, and on current available interest rates.

Alternatively, a buyer’s typical full-time earnings would need to increase by nearly three times current levels to afford the average B.C. home, said the report. It added, “Based on the last decade, actual earnings are expected to be flat.”

The report also said that a Millennial buyer saving for a 20 down payment on an average priced home would take 19 years, if saving 15 per cent of their typical pre-tax income each year. That’s 14 years more than in the mid-1980s when some of their boomer parents were buying homes.

In Metro Vancouver, the number of years needed for a Millennial on a typical salary to save 20 per cent on an averaged-price home ($1,050,000) rises to 29 years, longer than many of those buyers have been alive.

Generation Squeeze is working with the Canada Mortgage and Housing Corporation, and makes a number of recommendations to help improve general affordability for young Canadians. These include:

-

Reducing or removing other large, non-housing expenses – such as child care and parental leave, student debt and tuition, transit costs and more;

-

Building more purpose-built rental housing to accommodate the fact that people are renting longer;

-

Capture housing wealth windfalls through taxation, and remove tax-sheltered gains in housing;

-

Revitalize B.C. economy to improve earnings, with less reliance on real estate and development for GDP;

-

Find new measures to de-risk the market in order to bring down home costs in ways that support all Canadians, including those who already own property; and

-

Protect the housing market from inflation in regions where affordability has not already been lost.