The overall assessed value of residential buildings in the City of Prince George increased by 1.9 per cent in the latest figures from BC Assessment while business properties increased by 7.4 per cent and light industry by 12.6 per cent.

BC Assessment released its latest property assessments for the province on Jan. 2, with the figures based on the market values of properties as of July 1, 2024.

Those figures also include statistics for the rural areas around Prince George, which say that residential families there increased in overall value by 1.4 per cent, business properties by 2.6 per cent and light industrial properties by 13.8 per cent.

Rural Prince George is shown as going as far north as the southern end of Williston Lake and as far southeast as Mount Robson.

While the agency lists the top 500 assessed residential properties in the province, none of them are in Prince George.

However, the 100 top assessed residential properties list for the North Central region has a strong Prince George presence. Of that list, 33 are located within the City of Prince George and a further 13 are said to be in rural Prince George.

The highest-assessed residential property in the North Central region is a $4.8 million property near Moberly Lake, about 20 kilometres north of Chetwynd.

The highest-assessed residential property in Prince George is ranked second in the region is worth just over $4 million.

The typical assessed value of a single-family home in Prince George increased from $438,000 to $451,000, a rise of three per cent.

Property assessment values are made up of two components, the assessed value of the land and the assessed value of the buildings on the land.

“When establishing the market value for a particular property, BC Assessment considers each property's unique characteristics,” BC Assessment’s website says.

“These are the same characteristics that a home purchaser would consider, including size, layout, shape, age, finish, quality, number of carports, garages, sundecks and condition of buildings. Services in the area, location, views and neighbourhood may also influence a property's market value.”

The entire value of a property can be determined in one of four ways, which is chosen by BC Assessment based on the availability of data and the type of a property.

- Sales comparison: determining market value based on the sale price of comparable properties,

- Income approach: determining market value based on capitalized value of current rents and leases,

- Cost approach: basing market value on the replacement cost of a property and

- Prescribed approach: market value is determined on prescribed costs outlined by regulation or policy.

“Land is valued based on its highest and best use, meaning the reasonable and optimal legal use of property which is both physically possible and financially feasible,” the provincial government said. “For example, vacant downtown land may be valued at its development potential rather than existing use.”

Looking at a random single-family home on Rainbow Drive, the total assessed value increased in 2024 was $422,000. Of that figure, the land was assessed at a value of $196,000 and the buildings at $226,000.

In 2025, the land is now valued at $219,000 and the buildings at $218,000 for a total value of $437,000.

If we randomly select one of the homes near the westernmost end of St. Lawrence Avenue, we can see that it was worth $896,000 in 2024 and $895,000 in 2025. The data shows that the value of the land dropped from $223,000 to $199,000 while the value of the buildings went from $673,000 to $696,000, leading to a net decrease in value of $1,000.

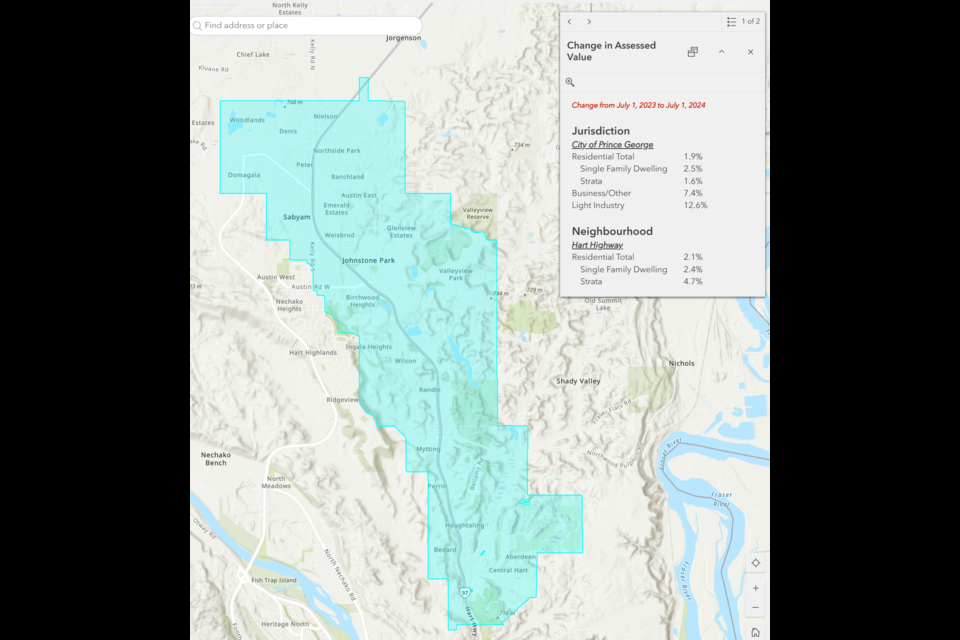

Looking at an interactive map provided by BC Assessment, we can also see the change in average assessed house value broken down by neighbourhood in the city.

The changes are:

- Northwest Prince George: 7.5 per cent increase

- Peden Hill: 4.9 per cent increase

- Southwest Prince George: 3.5 per cent increase

- Millar Addition: 3.2 per cent increase

- Quinson/Spruceland: 2.7 per cent increase

- Westwood/Pinewood: 2.6 per cent increase

- Highglen/Heritage/Lakewood: 2.6 per cent increase

- Upland-Landsdowne: 2.4 per cent increase

- Cranbrook Hill: 2.4 per cent increase

- Hart Highway: 2.1 per cent increase

- Southeast Prince George: 1.9 per cent increase

- Downtown Commercial: 0.8 per cent increase

- South Fort George: 0.6 per cent increase

- Central/Crescents: 0.4 per cent increase

- College Heights: 0.4 per cent decrease

- Strip Commercial: 0.7 per cent decrease

- Charella/Starlane/Tyner: 1.1 per cent decrease

- Northeast Prince George: 1.3 per cent decrease

Around Moccasin Flats, some properties have greatly increased in value from 2024 to 2025 while others have only seen small increases.

As an example the portion of the property on which The Citizen’s offices sit at 505 Fourth Ave. had a significant jump in value. The assessed value is now just over $2.7 million, up from around $2.2 million in 2024. That’s a 24 per cent increase.

BC Assessment’s website says that the value of the land increased from $1,085,000 in 2024 to $1,106,000 and the buildings value went from $1,092,000 to $1,602,000.

The other portion of 505 Fourth Ave. to the west had a similar increase in value of 25 per cent from $1,048,000 in 2024 to $1,313,000 in 2025.

At 693 Fourth Ave., the property value went up from $1,037,000 to $1,206,000.

On the property at 397 Third Ave., where the City of Prince George has built transitional housing for residents of Moccasin Flats, the assessed value has increased by two per cent from $631,000 to $643,000.

Further to the south, at 377 Lower Patricia Blvd., the value has gone up seven per cent from $130,200.

BC Assessment’s data doesn’t list the sale of any properties directly beside Moccasin Flats, but it does for some in the same commercial area.

For example, the property at 674 Second Ave. sold for $900,000 in October 2024. That’s both higher than the $609,000 it was worth in 2024 and more than double its 2025 assessed value of $445,000.

Down the road at 466 Second Ave., that property sold for $1.2 million. That’s slightly higher than the $1.192 million it was assessed at in 2024 and lower than its 2025 assessment of $1.38 million.

When 495 Second Ave. sold in May 2024 for $465,000, it was a lot more than its assessed value of $376,700. However, it was only slightly more than its 2025 assessed value of $463,900.

Another area property at 275 First Avenue sold for $400,000 in October 2024. That’s both higher than the 2024 assessment of $367,700 and the 2025 assessment of $383,100.

Likely Prince George’s most valuable property are the lands on which the University of Northern BC sit. In 2025, they are valued at $459,755,000 — nearly half a billion dollars.

BC has nine classes of properties: residential, utility, supportive housing, major industry, light industry, business, managed forest land, recreational and farm. The City of Prince George has tax rates set for properties in each of those categories.

The money the city collects in taxes shared between different funds it controls and with other entities, like the Fraser Fort-George Regional District and the Fraser Fort-George Regional Hospital District.

An assessment’s effect on the tax an owner pays on an individual property value changes relative to the average change of the value of the same type of property in the same community.

Those with an assessed value staying around the average could see their taxes stay the same while those higher or lower than the average may see those corresponding changes.

Something else that will have an impact on property taxes in Prince George is the city’s annual budget and the tax change approved by city council.

In 2024, city council approved a budget resulting in a 6.78 per cent property tax increase. Council has yet to deliberate the 2025 budget, but city staff have presented a proposed operating budget with a proposed tax increase of 6.55 per cent.

In BC Assessment’s North Central region, the communities with the highest assessed value increase for single-family homes were the Village of Burns Lake (19 per cent), the District of Tumbler Ridge (13 per cent), the District of Wells (10 per cent) and the City of Williams Lake (10 per cent).

Four communities had decreases in the typical assessed value of single-family homes: The Village of Valemount (five per cent), the Village of Daajing Gils (one per cent), the District of Mackenzie (one per cent) and the District of Hudson’s Hope (one per cent)

Three communities in the area, the districts of Kitimat, Houston and Stewart, saw no increase or decrease in the typical assessed value of a single-family home.

For strata homes, defined as either a condo or a townhouse, the typical assessment rose from $252,000 to $265,000, an increase of five per cent.

The changes in typical assessed strata values in the six other communities listed are as follows: City of Terrace (11 per cent increase), City of Williams Lake (11 per cent increase), Town of Smithers (9 per cent increase), City of Dawson Creek (one per cent decrease), District of Kitimat (three per cent decrease) and the City of Fort St. John (nine per cent decrease).

Overall, the number of assessed properties in BC increased by one per cent year-over-year to a total of 2,207,009. The total value of assessed real estate in BC is now $2.83 trillion, an increase of 1.5 per cent from 2024.

That includes $38.3 billion in value added from new construction, subdivisions and rezoning. Overall, BC Assessment said 99 per cent of British Columbians accepted their property assessments last year, meaning they didn’t appeal them.

A residential property’s assessed value is important for BC residents looking to take advantage of the province’s home owner grant.

A registered owner of a residential property who lives in BC, is a Canadian citizen or permanent resident and occupies the property they’re applying for the grant for can get up to $570 towards their property taxes if they live in the Capital Regional District, the Fraser Valley Regional District or the Metro Vancouver Regional District and up to $770 in the rest of the province, including Prince George.

To get the full grant amount, a property must not be worth more than $2,175,000. After that threshold, the grant amount is reduced by $5 for each $1,000 above the value.

A property owner also must pay property taxes worth at least $350 to qualify for the grant. Applications can be submitted any time during a tax year, though the province says the best time to do so is after getting your assessment notice and before your property taxes are due.

Applications can also be made retroactively.

For property owners looking to appeal their latest assessments, there isn’t much time to do so. Notices of complaint with BC Assessment and the Property Assessment Review Panel must be filed by Jan. 31. Appellants are given a 30-minute hearing before a panel in which to plead their case.

More information about filing a complaint with the PARP can be found online at gov.bc.ca/gov/content/housing-tenancy/owning-a-home/property-assessment-review-panels2.

Those wanting to appeal a decision by the PARP to the Property Assessment Appeal Board must then do so by April 30.

Appeals to the PARP are free but appeals to the PAAB come with a non-refundable $30 filing fee for residential, recreational, non-profit and farm property owners and a nonrefundable $300 filing fee for industrial and commercial property owners.

To help property owners assess whether they have a strong enough case to launch an appeal, the PAAB has an interactive online tool where you can outline your concern with your assessment and find out what evidence you need to be successful.

For instance, the tool says that arguing that your assessment is higher than other properties is not usually successful and that the board cannot help in the case where an appellant is merely concerned with their taxes being too high.

BC Assessment recommends that property owners review their assessment and the assessments of similar properties before filing an appeal. It also encourages property owners to reach out to their staff to see if the issue can be resolved before filing an appeal.

Assessment rules are different for lands within Indigenous communities or leased from Indigenous communities. There are also different rules for different Indigenous communities based on how recently their assessment and taxation laws were passed or what appeal body they belong to.

More information on those rules can be found online at info.bcassessment.ca/Services-products/appeals/First-Nations-Complaint-Appeal-Process.