Prince George homeowners can expect their 2019 property assessment in the mail any day now.

B.C. Assessment says the average assessed value for single-family residential properties in Prince George increased by 10 percent. That equates to $270,000 in 2018 and $296,800 in 2019.

Condo values also saw a jump in value this year as the average assessed value increased by nine per cent. That equates to $149,400 in 2018 and $163,300.

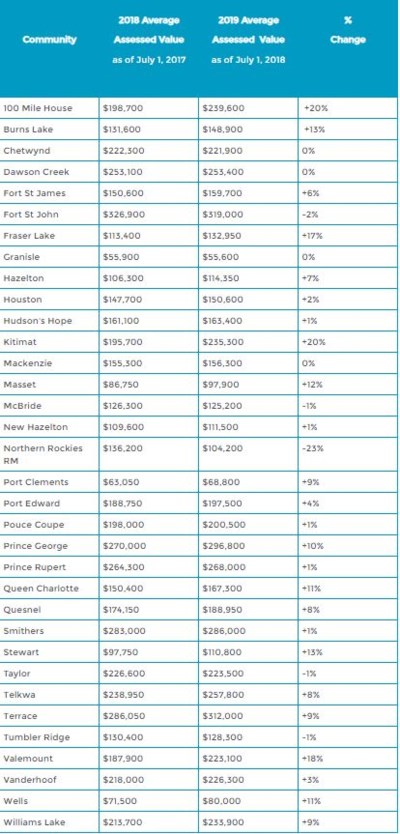

Singe-family residential properties via geographical area (via B.C. Assessment).

Singe-family residential properties via geographical area (via B.C. Assessment).One exception to the trend was Kitimat, which saw a 20 per cent increase in average assessed value, while strata residential properties rose 31 per cent.

In terms of specific neighbourhoods in Prince George, Cranbrook Hill has seen the biggest jump for residential single-family properties; the value has risen 14.4 per cent.

That breaks down to an assessed value of $393,500 in 2018 and $449,000 in 2019, which is a difference of $55,000.

Other big gains were seen in residential strata throughout the city. Condos in South Fort George jumped 15.09 per cent, condos downtown went up 14.9 per cent and condos on the Hart Highway increased 10.2 per cent.

Decreases were seen in condos in the VLA, which fell by 7.57 per cent. The only neighbourhood where residential single-family properties saw a decrease is Peden Hill. Values there dropped by 1.98 per cent.

Overall, northern B.C.'s total assessments increased from about $61.5 billion in 2018 to $65.7 billion this year.

A total of about $913 million of the region's updated assessments is from new construction, subdivisions and rezoning of properties.

The northern B.C. region encompasses approximately 70 per cent of the province stretching east to the Alberta border, north to the Yukon border, west to Bella Coola, including Haida Gwaii, and to the south, just north of Clinton.

If a homeowner has an issue with their assessment, they have until Jan. 31 to submit a notice of complaint.

B.C. Assessment is also reminding homeowners that increases in property assessments do not automatically translate into a corresponding increase in property taxes. How your assessment changes relative to the average change in your community is what may affect your property taxes.

“A really good suggestion that I have is for people to go to our website and use the interactive search there,” says Krantz.

“What you can do is find a lot of information there including assessment for your own property as well as property throughout the community and you can actually look at sales that we have been looking at for those communities as well.”

Currently, the City of Prince George is considering a 5.03 per cent tax increase, which could change in the coming months.

For more information, call B.C. Assessment at 1-866-825-8322 or visit bcassessment.ca.